Forecasted Power Price Methodology

As at 31 March 2025

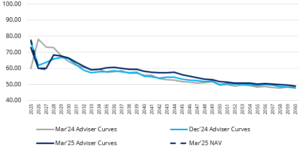

Power Curve Assumptions

For the UK portfolio, the Company uses multiple sources for UK power price forecasts. Where power has been sold at a fixed price under a Power Purchase Agreement (a hedge), these known prices are used. For periods where no PPA hedge is in place, short-term market forward prices are used. After two years, the Company integrates a rolling blended average of three leading independent energy market consultants’ long-term central case projections.

For the Italian portfolio, Power Purchase Agreements (hedges) are used in the forecast where these have been secured. In the absence of hedges, a leading independent energy market consultant’s long-term projections are used to derive the power curve adopted in the valuation.

Power Sales Strategy

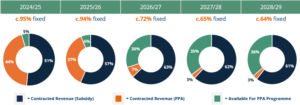

NextEnergy Solar Fund continues to lock in PPAs over a rolling 36-month period. This proactive risk mitigation helps secure and underpin both dividend commitments and dividend cover, whilst reducing volatility and increasing the visibility of cash flows.

Forecasted Total Revenue Breakdown 1,2,3,4:

Footnote:

- Fixed revenues include subsidy income.

- Figures are stated to the nearest 0.1% which may lead to rounding differences.

- NextEnergy Solar Fund minimises its merchant exposure through its active rolling PPA programme. The programme locks in PPAs in the liquid market to ensure maximum contracted revenues are achieved.

- Fixed prices (£/MWh) cover 85% (826 MW) of the total portfolio as at 6 August 2024.

Renewable Energy Guarantees of Origin (“REGOs”)

The Company sells REGOs bundled with power sales through existing PPAs as well as unbundled via bilateral arrangements. Where REGOs have been sold at a fixed price, these known prices are used in the calculation of NAV. 93% of REGOs generated for the 2024-25 compliance year have been sold at an average price of £3.9/MWh. 29% of expected REGOs for the 2025-26 compliance year have been sold at £6.9/MWh. Unbundled, unsold REGO volumes of up to c.645GWh/annum are reflected in the NAV in line with third-party advisor forecasts (£5/MWh until March 2028 and then £1.5/MWh for the remaining life of the asset).