Downloads

AGM Notice

AGM Results

AGM Recording

Introduction to Notice of AGM 2025

The eleventh annual general meeting of the Company will be held at 12:00 noon on 20 August 2025.

A number of Resolutions are being proposed in relation to the ordinary administrative business of the Company.

Full details of the Resolutions to be proposed are set out in the AGM Notice in Part 3 and explanatory notes to the Resolutions are set out in Part 4 under the heading “Explanatory Notes to the Resolutions to be proposed at the AGM”.

The AGM Notice 2025 explains in more detail one of the proposals which relates to the continuation of the Company, SPECIAL RESOLUTION 13 (the “Discontinuation Resolution”), and why the Board unanimously recommends that Shareholders VOTE AGAINST the Discontinuation Resolution.

Direct Link to AGM Notice 2025 here

How to vote

Listen to the AGM live on the 20th August 2025 at 12:00 PM (BST) here

The Board of Directors’ Full Voting Recommendations

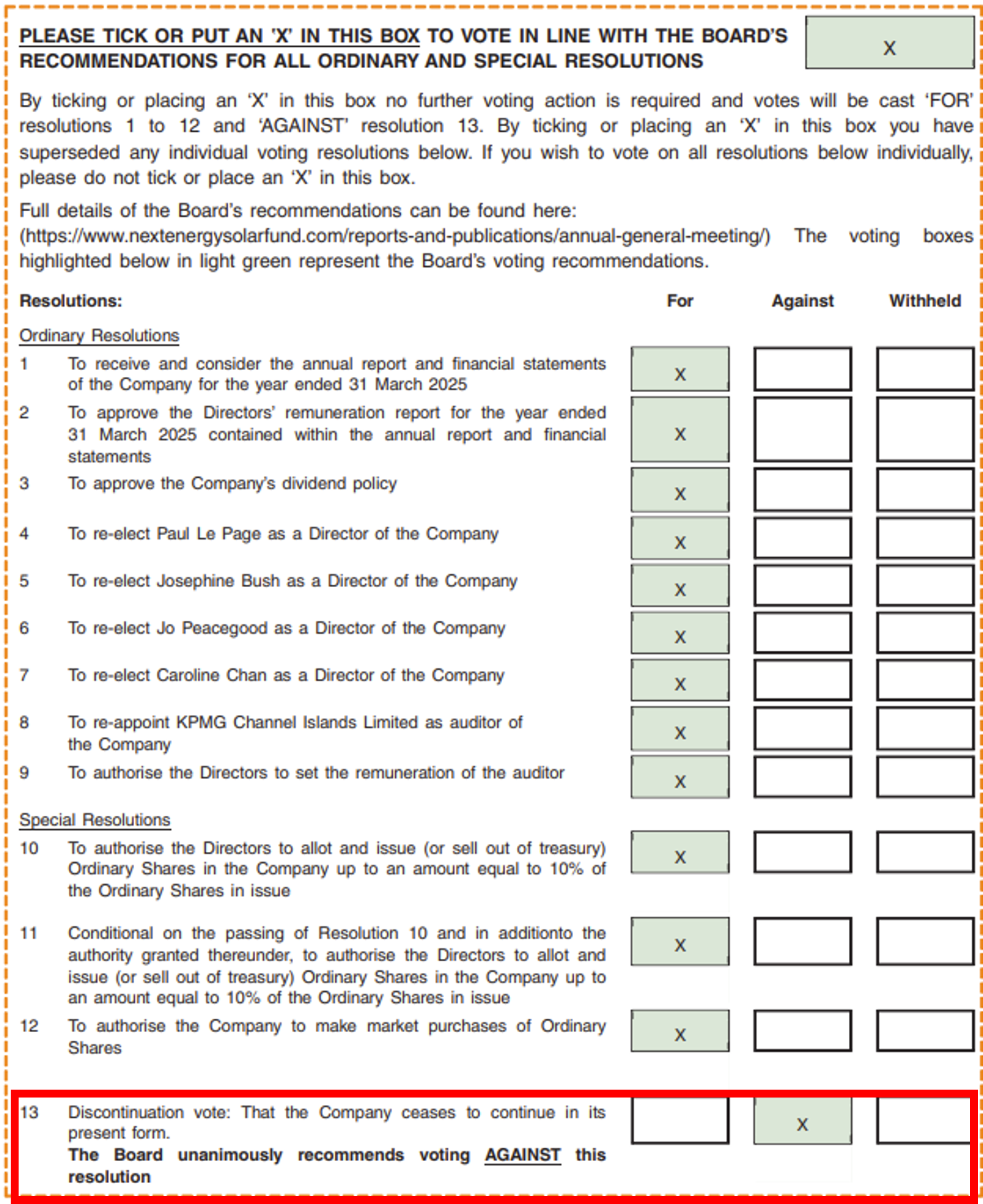

Please find here a completed Form of Proxy example of how the Board would recommend voting at this AGM. As noted, there are two ways in which Shareholders can vote, either by ticking or putting an ‘X’ in the first box to select voting in line with the Board’s recommendations or by selecting the individual resolutions below.

Background and Rationale to Vote Against Discontinuation (Special Resolution 13)

Since the Company launched on the London Stock Exchange in April 2014, it has delivered consistent growth, resilience, and returns for its Shareholders. As at 31 March 2025, the Company has delivered a total ordinary shareholder return of 42% inclusive of dividends and the current Ordinary Share price discount to NAV. As at 31 March 2025, the Company had a total Gross Asset Value of £1,061 million and owns a high-quality portfolio of 100 solar assets, 1 energy storage asset, and a $50m investment into the private solar fund, NextPower III, providing a total installed capacity of 937MW, enough to power the equivalent of c.265,400 homes per year.

The Company’s investment objective is to provide Shareholders with attractive risk-adjusted returns, principally in the form of regular dividends, by investing in a diversified portfolio of utility-scale solar energy and energy storage infrastructure assets. The Company has consistently achieved this objective by providing Shareholders with a covered and progressive dividend every year for the last 11 years, having declared £395 million of Ordinary Share dividends since its IPO, equivalent to 74.2p per Ordinary Share.

The Company maintains a progressive annual dividend policy, whilst preserving the capital value of its investment portfolio through reinvestment of excess cash flow. The Company continues to lead the sector through its work to generate risk-adjusted returns while addressing the linked challenges of climate change and nature loss. The Company therefore prides itself on its market leading transparent disclosures, including meeting the requirements of Article 9 of the European Union Sustainable Finance Disclosure Regulation and being fully aligned with the EU Taxonomy. This work is at the cutting edge and is intended to provide a clear picture to investors and other NESF stakeholders of how NESF monitors and acts on risks and opportunities.

This past financial year has been one of deliberate action, disciplined execution, and proactive capital management, all focused on strengthening NESF’s long-term value proposition. Under the Capital Recycling Programme, the Company has sold 145MW of capacity, raising £72.5 million in total capital. This represents three out of four phases now delivered, and has generated a Net Asset Value uplift of 2.76p per Ordinary Share to date. The final phase, covering the remaining 100MW, is currently progressing through a competitive third-party sales process. The Board notes that the speed of the Capital Recycling Programme has been slower than anticipated due to the current M&A environment across the renewables market and is working hard alongside the Company’s Investment Adviser to seek to ensure the final phase of the initial capital recycling programme is completed and value accretive to Shareholders. Alongside recycling capital, the Company has been focused on returning capital to Shareholders.

In June 2024, the Board launched an up to £20 million Share Buyback Programme, under which over 15 million Ordinary Shares have been repurchased to date at an average price of 74p, totalling £11.2 million. In addition, the Company has paid £49.2 million in dividends for the year ended 31 March 2025, in line with the dividend target of 8.43p per share, a clear signal of consistency and Shareholder alignment. The Company has made material progress on reducing debt. Over the year, NESF reduced overall debt by £59.5 million. This includes repaying £46.8 million in short-term revolving credit facilities, primarily using proceeds from the Capital Recycling Programme, as well as repaying £12.7 million in long-term amortising debt from operating cashflows. The Company also simplified and 5 consolidated its revolving credit arrangements into a more efficient structure, now benefiting from a highly competitive margin of 1.20 per cent. over SONIA. The NESF Board collectively holds nearly 209,389 Ordinary Shares, and employees of the Company’s Investment Adviser (NextEnergy Capital Limited), hold approximately 2 million Ordinary Shares, ensuring continued alignment with Shareholders’ long-term interests. Together, these initiatives underscore the Company’s commitment to active management, capital discipline, and value delivery. NESF remains focused on protecting and enhancing Shareholder returns, while reinforcing the strong foundation on which the Company continues to grow.

Under the careful stewardship of the Board, the Investment Manager and the Investment Adviser, the Board strongly believes the Company continues to provide risk-adjusted returns for its Shareholders and therefore unanimously recommends that Shareholders VOTE AGAINST SPECIAL RESOLUTION 13 (the Discontinuation Resolution).