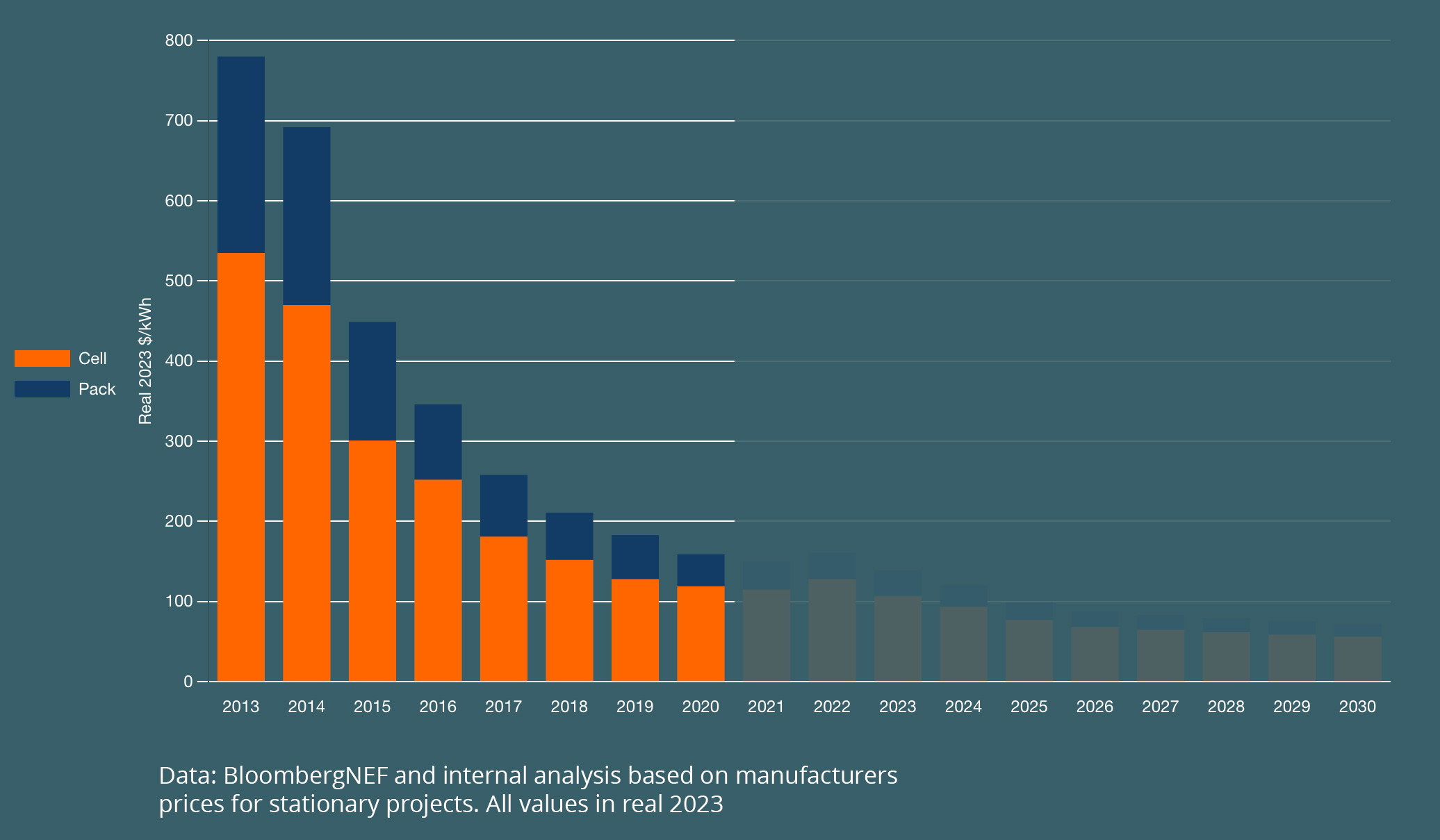

BESS CAPEX has seen significant reductions since 2013

Drag the graph to view more

Data: BloombergNEF and internal analysis based on manufacturers prices for stationary projects. All values in real 2023

Phase I: 2013-2020

CAPEX for grid-scale battery projects fell drastically, due to improvements in lithium iron phosphate (“LFP”) battery chemistry and production economies of scale driven by demand in EVs.

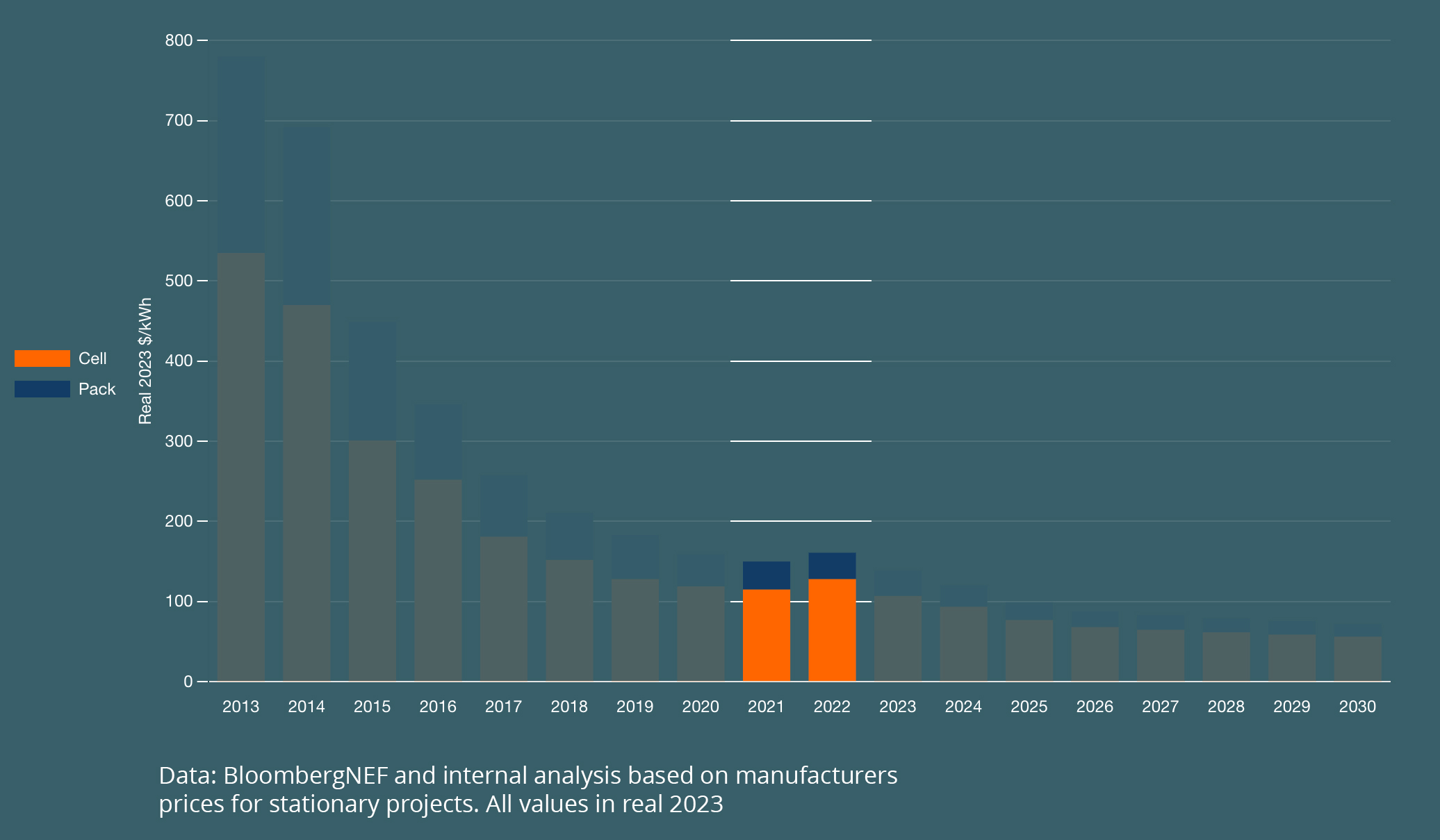

Phase II: 2021-2022

Fall in CAPEX was hindered by supply chain issues associated with the global pandemic and growth in lithium demand.

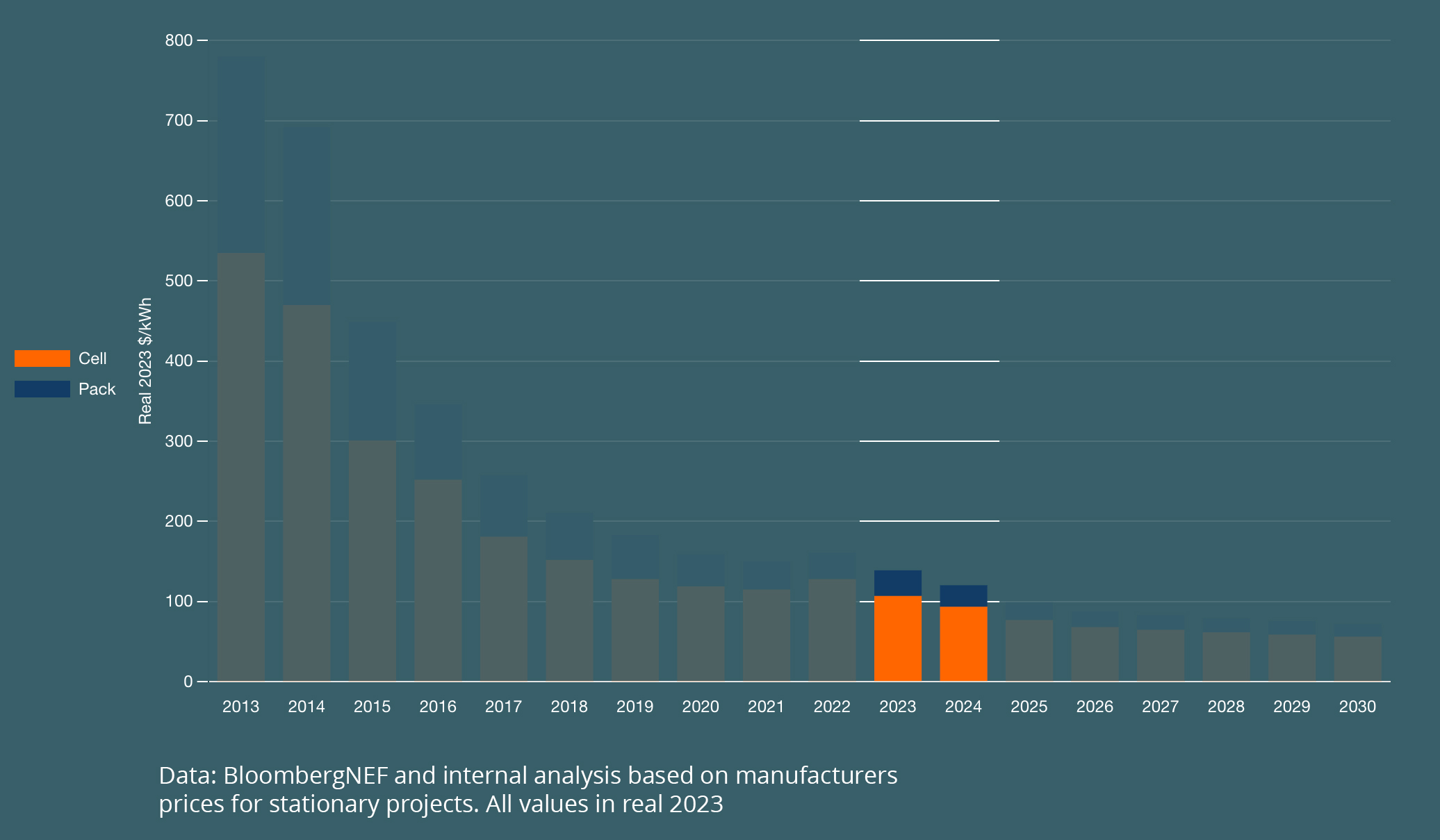

Phase III: 2023

CAPEX for battery projects return to a decline trend as lithium prices saw a sharp decline during 2023 and supply chain issues started to be resolved.

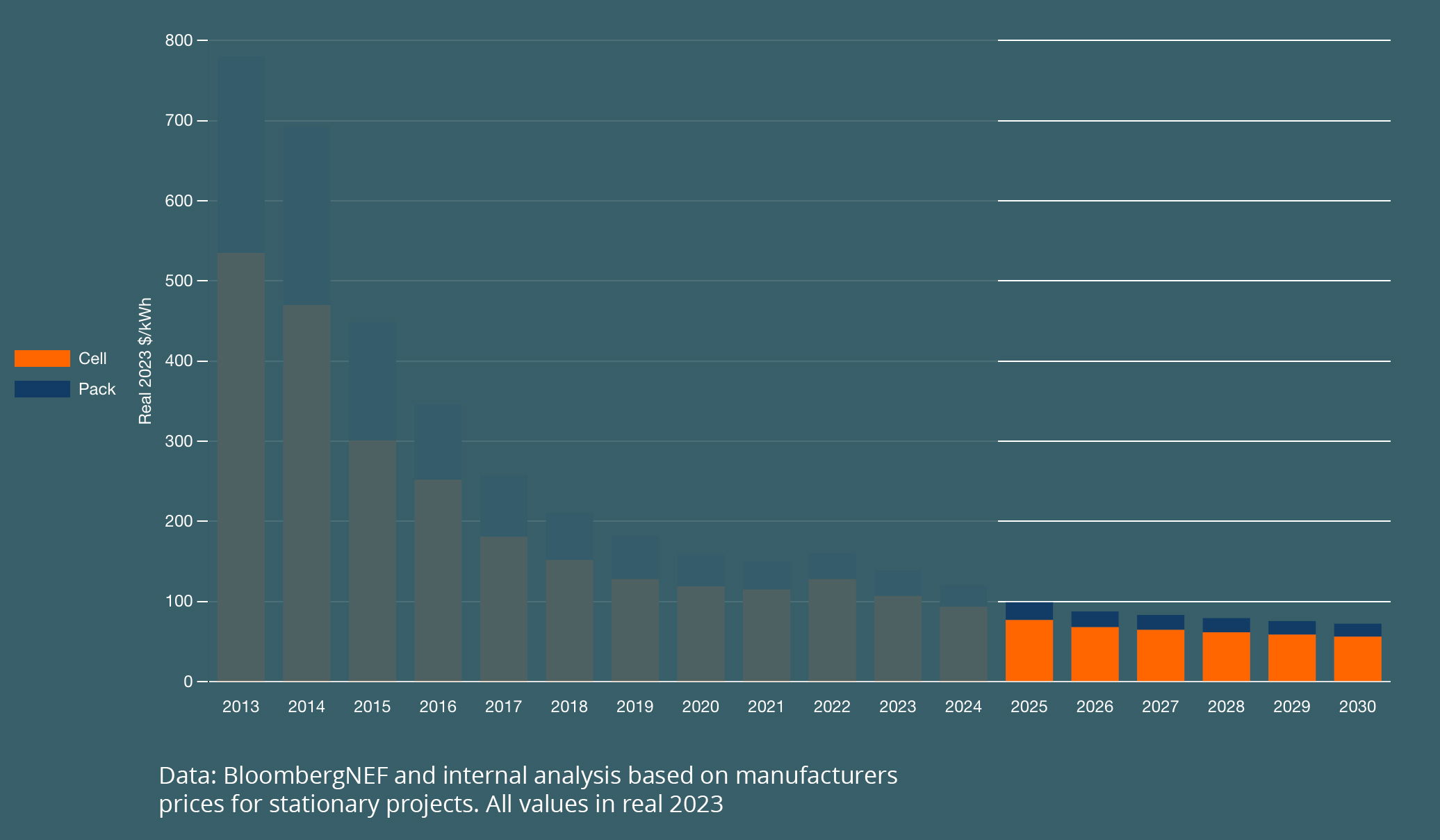

Outlook

Battery costs are expected to decline out to 2030. Estimates suggest that almost half of the decline will come from declining prices of raw materials such as lithium, nickel, and cobalt. Battery pack prices are now expected to fall by an average of 11% per year from 2023 to 2030.

This in turn will drive improved investor returns, greater deployment and higher battery duration.