Capital Structure

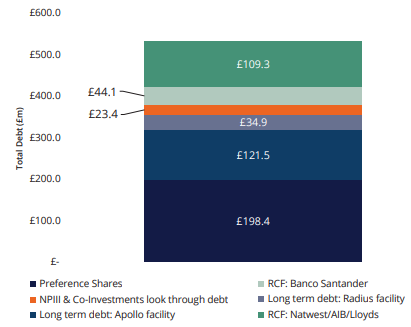

- The Company’s financial debt (excluding preference shares) is currently £292.1m which represents a gearing of 29.7% of GAV (31 December 2024: 28.6%).

- The Company also includes non-amortising preference shares as part of the debt structure and therefore values the total gearing of the Company at 48.4% of GAV (31 December 2024: 47.2%).

- Of the Company’s total debt 1, 70% remains at a fixed rate of interest (including the preference shares) and 30% is a floating rate at an attractive margin (SONIA + 1.20%).

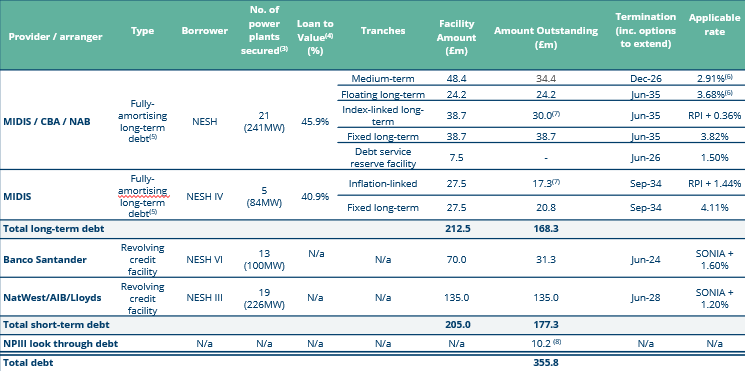

- Breakdown of total debt (including preference shares) as at 30 June 2024:

Footnote:

- Excluding NextPower III look through debt totalling £23.5m as at 31 March 2025.

Available Capital (30 September 2024)

Out of the total £205m immediate RCFs available to the Company, c.£61.2m remains undrawn and available for deployment as at 30 June 2024. The Company has c.£3.8m immediate cash balance available at Company level as at 30 June 2024 (this is separate from the cash currently held at Holdco/SPV level).

Preference shares simplify the capital structure by reducing the exposure to secured debt financing

Preference Shares

On 8 November 2018, the Shareholders approved the issuance of £200m of Preference Shares. The Company issued the first tranche of £100m in November 2018, and the second tranche of £100m Preference Shares were issued in August 2019.

Value accretive features:

- lower issue cost of 1.1% compared to other capital raising avenues

- lower cash cost with a fixed preferred dividend of 4.75% and no redemption requirements

- option to redeem at nominal value starting from 1 April 2030 for six years at sole discretion of the Company

- non-redeemable / non voting shares(1) with holder’s conversion right starting from 1 April 2036 at nominal value (plus unpaid dividend if any) relative to NAV per Ordinary Share at the date of conversion (thus no refinancing risk)

Why Preference Shares:

- The issuance of £200m preference shares is expected to increase dividend cover by 0.15x and returns by 1.09% for ordinary shareholders (2)

- Preference shares simplify the capital structure by reducing the exposure to secured debt financing

- Preference shares provide protection against diminishing power prices compared to traditional debt financing used by peers and have no refinancing risk

- Issuance of £200m preference estimated to have increased cashflows by £6.0m during the year compared to a proforma debt financing

Footnote:

(1) Redemption rights in the event of delisting or change of control of the Company – Voting rights in the event of detrimental changes to the Investment Policy or Articles.

(2) Estimates only based on a typical UK solar portfolio and when compared to issuance of new ordinary shares.

Financial debt breakdown (31 March 2024)

Financial Debt Gearing: 29.3%

Total gearing (5): 46.4%

Footnotes:

- NESF has 326MW under long-term debt financing, 326MW under short-term debt financing and 250MW without debt financing (excludes NPIII look through debt).

- Loan to Value defined as ‘Debt outstanding / GAV’.

- Long-term debt is fully amortised over the period secured assets receive subsidies (ROCs and others).

- Applicable rate represents the swap rate.

- Represents the “real” outstanding debt balance. The “nominal” outstanding debt balances are included in the debt balances provided in Note 23b to the interim results financial statements.

- The total combined short and long-term debt in relation to NESF’s commitment into NPIII (on a look through equivalent basis).

At 30 September 2023, the Company’s subsidiaries (including NPIII) had financial debt outstanding of £356m (31 March 2023: £345m), on a look-through basis. No covenant breaches have occurred during the period.

[This data is updated at Full Year & Interim Results]